The

run-up to the Union Budget has seen a plethora of ‘experts’ (bankers, corporate executives, investors, economists,

journalists, etc.) voicing their opinion of what the Union Budget FY2013

should look like. The Union Budget is probably the most hyped up event in the economic

calendar. From being a simple event of the government declaring the profit and

loss account of the public finances, it has undergone a metamorphosis, whereby

the government now provides a snapshot of the nitty-gritties of the economy, policy

ingredients, and guidance for the next fiscal year. Nobody gains from this

parliamentary Budget session as much as the media. In fact, judging by the past

few years, the Budget has been more of the TRP (Television Rating Point) event than a GDP (Gross Domestic Product) event.

Budget

Day in India is somewhat of a close follower of the British counterpart. For

many years in Britain, the Chancellor of the Exchequer ceremonially enters the

House of Commons with a Victorian-era ‘budget box’ briefcase. In similar

fashion, Indian Finance Minister Pranab Mukherjee clutched his red leather

briefcase as he entered the Indian Parliament building. Mr. Mukherjee presented

India’s 81st annual Budget on March 16th; Individually,

it was his seventh, the second highest by any Finance Minister in India. Several

‘experts’ were hoping the budget would introduce the much-awaited reforms that

would spur economic growth, and bring back the investor confidence. The key

reforms anticipated by the markets included:

- A revamp of Tax-structure by introducing Goods and Service Tax (GST) and a Direct Tax Code (DTC)

- Allowing Foreign Direct Investment (FDI) in sectors such as Aviation, Retail, and Insurance

- Trimming the fiscal deficit

- Removing infrastructure bottlenecks

- Breakup of the state-run Coal monopoly

- Cutting back on subsidies (Fuel, Fertilizer, and Food)

- Maybe even some tax relief for the middle class

However, one doesn’t need to be a

genius to realize that making everybody happy was impossible. The FY-2013

Budget, like most of its predecessors, stuck to the age-old trend of taxing

consumption, raising taxes for existing taxpayers to pay for the handouts given

to the impoverished, bail-out ailing sectors, and optimistically talk about

reforms to come. The emphasis was on Inclusive Growth, with increased spending

on agriculture, healthcare, and education. Little wonder that his choice of

literary quote was from Hamlet: “I must

be cruel, only to be kind”, compared to Dr. Manmohan Singh citing Victor

Hugo in 1991, “a reformed and

confident India was an idea whose time had come”.

The FM started his budget speech reminding

everyone of the tough global economic environment (high oil prices due to tensions in the Middle East, European Crisis, the

usual suspects really). Then he moved on to present India’s economic

performance. FY2012 GDP growth rate pegged at 6.9%, compared to 8.4% in the

previous year. GDP growth for FY2013 expected to be around 7.6%. Then he

moved on to talk about fiscal consolidation, saying that issues regarding

public finance – something that investors and the RBI have been demanding for

quite some time now – would be addressed. The fiscal deficit, targeted at

4.6% of the GDP, was likely to be around 5.9% for the year ending March 2012.

However, factoring in the states’ deficit, and off-balance sheet items, the overall deficit

could touch 9%. He announced the target for next fiscal year to be 5.1% (and below 4% in 3 years), which would be

achieved on the back of increased service and excise taxes, and subsidy

expenditure reduced to 2% of the GDP (and

1.7% in 3 years) from about 2.7% now. It also set a divestment

target of Rs 300 billion for FY2013 compared to its FY2012 target of Rs 400

billion, of which it only managed to raise Rs. 139.1 billion (through an FPO of Power Finance Corp. and a

5% stake auction on Oil &Natural Gas Corp.)

He also tried to excite the financial

markets by proposing Qualified Foreign Investors (QFIs) access to Indian

Corporate Bond Markets; and incentivize greater participation by retail investors in equity markets through Rajiv

Gandhi Equity Savings Scheme, which would give them 50% income-tax deduction

upto Rs. 50,000. Then he announced that small investors could e-vote in companies.

Obviously their e-vote would not be sufficient to stop the Government from

looting PSUs (Remember ONGC?). Furthermore,

he lowered

the Securities Transaction Tax (STT)

to just 0.1%.

Mr. Mukherjee then moved on to talk

about the bottlenecks in the economy:

- Provided Rs 158.88 billion for recapitalization of public sector banks, regional-rural banks, and other financial institutions like National Bank for Agriculture and Rural Development (NABARD)

- Allowed another Rs. 600 billion worth of tax-free bond issuances to fund infrastructure projects

- Cut customs duty on imported coal to ensure fuel supply for power generation

- Directed Coal India to sign long-term Fuel Supply Agreements (FSAs) with Power plants

- Allowed Airlines to raise more foreign loans (ECBs) for Working Capital

- Allowed ECBs for Capex Requirements of Infrastructure Projects (more specifically, power projects, roads and highway projects)

- Set up a Credit Guarantee Trust Fund and allowed ECBs for Low-Cost Housing Projects to address shortage of affordable housing in many cities

- Provided for Telecom Towers to get viability gap-funding

- Increased funding for National Rural Health Mission (NRHM) to Rs. 20.8 billion

- Announced a “White Paper” is being prepared to deal with on black money (illicit funds) stashed both, at home and abroad

- Increased Defense spending by 17% to Rs. 1.93 trillion

- Provided Rs. 255.55 billion to the Right to Education, a 21.7% yoy increase, and also proposed setting up a Credit Guarantee Fund for students

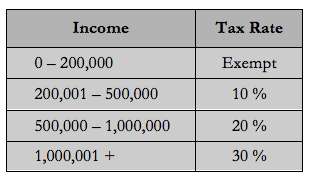

Finally he spoke about Taxes. On

personal taxes, he enhanced the basic limit for tax exemption to Rs. 200,000,

and expanded the 20% tax slab upto Rs. 1 million. The new tax slabs is illustrated

below. Furthermore, there would be no separate tax slabs for women.

Interest-income upto Rs. 10,000 from savings account in banks or post offices

would now be tax-free. But custom duty on Gold and Platinum were increased (understandably so, to curb gold imports and

to channel that money into more productive areas of the economy). Additionally,

Sin

tax increased on some tobacco products.

There was no change in

corporate tax rates. Broadly, service taxes and general excise duties were hiked to 12%. However,

peak excise duty remains unchanged at 10%. This surely would be inflationary as

services account for 59% of our GDP. I have compiled a chart to illustrate

which goods or services will now cost more and which will cost less.

Overall, Union Budget 2013 was expected

to deliver big-bang reforms. But all it had to offer was the traditional mix of

more public spending and reshuffled taxes, none of which will be revitalize the

stalled engines of economic growth. However, one announcement that was big bang

in nature was that of General Anti Avoidance Rules (GAAR),

a proposal to amend tax laws to retroactively levy capital gains tax on

Indian assets (even on deals that take place abroad by foreign

entities). This would apply to transactions as far back as April 1962. It

appears that the amendment is principally aimed at taxing Vodafone, but this

could well scare off foreign investors – the same people who fund India’s

current account deficit; the same people that the Indian Government has been

trying to woo.

Brief Background on Vodafone Case:

The British telecom giant bought an Indian operator from Hutchison

Telecom of from Hong Kong in an offshore deal in 2007 for $11 billion. However,

the Supreme Court of India, in January 2012, ruled that Vodafone should not

have to pay a $2.2 billion tax that the Indian government claimed.

Later in the day, Mr. Mukherjee tried

to explain that the government was only clarifying the 1962 tax law, and trying

to close a loophole that allowed some companies to structure transactions in

tax-havens such as Mauritius, purely to avoid paying any capital gains tax. “We are making it very clear that it is the

law of the land — this is the intention of the legislature,” he said on

NDTV, a news channel.

My Reaction

The Union Budget continued with the present

Government’s theme of Inclusive Growth. Thankfully however, it refrained from

announcing any extremely populist measures, especially considering its poor performance

in recent state elections. Instead, it focused on fiscal consolidation. However, no big-ticket reforms were announced either. It seems like whatever additional revenues

they’re raising will all be diverted to welfare programs and wasteful subsidies.

So in short, our government continues to play Robin Hood.

The government has missed targets

before. Furthermore, the last 2 quarters have seen so many revisions that

government estimates can no longer be considered a reliable source. There is

something really wrong with the way the official statistics are calculated and

maintained. Hence pardon my cynicism but I’d take these Budget numbers with a

pinch of salt too.

One major takeaway is that the

government has missed an opportunity to deliver reforms and jumpstart the

productive engines of the economy. I was not expecting the budget to deliver

too much, but at least a few reforms were desperately needed. Politics is once

again driving the nation at the detriment of economics.

We witnessed this two days ago as well,

when a coalition ally Ms. Mamata Bannerjee, populist leader of West Bengal based

Trinamool Congress, demanded the Railway Minister (who belongs to her own party) to be fired.

His crime? Proposing a

fractional rise in rail fares to modernize Indian Railways and improve its safety

and hygiene. The rail budget was forward-looking, and the fare-hike was very

modest, ranging from 2p – 30p per kilometer (or 0.04 – 0.6 cents per km); the fares had not been revised since 8

years. But by proposing this, Rail Minister Mr. Dinesh Trivedi had apparently “gone against the Trinamool Congress Party’s

DNA” and that was unacceptable. Imagine their reaction if the government

proposed privatizing the railways.

With such obstructing allies, it would

be near impossible for the Congress to carry out any significant reforms even

if they had a stomach for them. Another problem is that India Inc is a spoilt

bunch that loves to sulk; hence business and investment climate will not

improve until some policy action from the government. This budget failed to do

that. The measures announced were marginal at best. It didn’t help RBI either.

The central bank is terrified that inflation would pick up again, reflecting a

host of supply-side constraints ranging from agricultural supply chain to

inadequate infrastructure.

So what should the Budget have focused

on? Even taking baby-steps, but in the right direction, can go a long way to

fixing things. In addition to all that Mr. Finance Minister announced, he should

have formed a Priority Group to maneuver the following:

- Raise diesel prices, incrementally and quietly, but offset that by matching cuts in the tax on diesel. That way, the fiscal hole starts getting plugged, and the consumers don’t feel much of a pinch.

- Set-up a facility to fast-track land acquisition and environmental clearances. This would kick-start the implementation of stalled projects, which would create employment along with boosting infrastructure, and housing markets, financial markets, and business sentiment – and all this without investing a single new penny.

- Present a draft on GST and DTC, outlining how the overall economy (include every stakeholder) would benefit from it. Start discussions with an established deadline for the rollout.

- As of now, India has only 790 diplomats and ambassadors, compared to about 3,000 in Brazil, over 6,000 in China, and well over 20,000 in America. While this may not have much of a direct impact on Indian’s finances (except their payrolls), it does increase India’s presence in different nations. This not only helps in economic ties, but also strategic ties. For a nation trying to strengthen its global footprint, India is severely under-represented on a diplomatic level.

In a separate post, I would like to

share 2 open letters addressed to Finance Minister Pranab Mukherjee in response

to his budget announcement. They sum up pretty well how some segments of the

economy will be affected. A transcript of his BS (I mean Budget Speech) can be found here:

No comments:

Post a Comment